How to calculate cost of borrowing

Calculate Your Rate in 2 Mins Online. There are plenty of factors that come into play when calculating the cost of.

Accounting For Borrowing Costs Overview And Example Accounting Hub

Required Calculate the eligible.

. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. If APR were a puzzle it would have many pieces. Ad Low Interest Loans.

The new AIR or the new EIR are often called the TOTAL COST of BORROWING or THE COST OF BORROWING. How to use our calculator. If the effective tax rate on all of your debts is 53 and your tax rate is 30.

You must however pay back 250000 to the lender. Enter the amount into the box. Enter B4_B3_12 into cell B5 to calculate the total cost of the loan by multiplying the number of monthly payments times the cost of each monthly payment.

One Form Multiple Offers. Aside from having a margin account shorting a stock requires having your broker locate the shares for you to short -- you are borrowing someone elses shares and selling. 30 years Interest rate.

The calculator is mainly intended for use by US. This will show you how the. Get The Money You Need.

This will show you how the interest rate affects. Choose how much you want to save or borrow. The answer is 1392.

For example if the lender assesses a fee of 5 and the loan amount is 250000 the fee will be 12500 and you will receive 237500. Borrowing from a 401 k Thinking of taking a loan from your 401 k plan. Since the interest rate is a semi-annual figure we must convert it to an annualized figure by multiplying it by two.

Lets take the example from the previous section. Financing costs are defined as the interest and other costs incurred by the Company while borrowing funds. Pre-Tax Cost of Debt 28 x 2.

W4 Weighted Average Borrowing Cost Rate. Ad Need a Personal Loan but Have Bad Credit. Use this calculator to find out how much a loan will really cost you.

Calculating after-tax cost of debt. Before you do you should check out the true costs of such a loan with this calculator. W4 Weighted Average Borrowing Cost Rate.

Semi-Annual Interest Rate 28. Ad Comprehensive Customized Solutions To Help Achieve Your Organizations Financial Goals. The formula to calculate simple interest is.

Tip Change the interest rate. 40000 9 3125 Eligible Borrowing Cost 32875 W3. This will show you how the interest rate affects.

Compare Get Personal Loans Here. Cost of Borrowing Calculation. They are also known as Finance Costs or borrowing costs.

The cost of borrowing varies depending on the type of loan you take out so its important to. Annual percentage rate or. Commercial Banking Made Seamless With Union Bank Schedule A Call Today.

You need to check with the local state. W5Cost of the Asset at 31122013 250002000015000 6545 66545. Use the slider to set the.

How APR the cost of borrowing is calculated. The frequency of repayments for. Want to Learn More.

Use the personal loan calculator to find out your monthly payment and total cost of borrowing.

Degree Of Total Leverage Meaning Calculation Importance And More Financial Ratio Learn Accounting Financial Management

Interest Rate Vs Annual Percentage Rate Top 5 Differences Interest Rates Percentage Rate

Understand The Total Cost Of Borrowing Wells Fargo

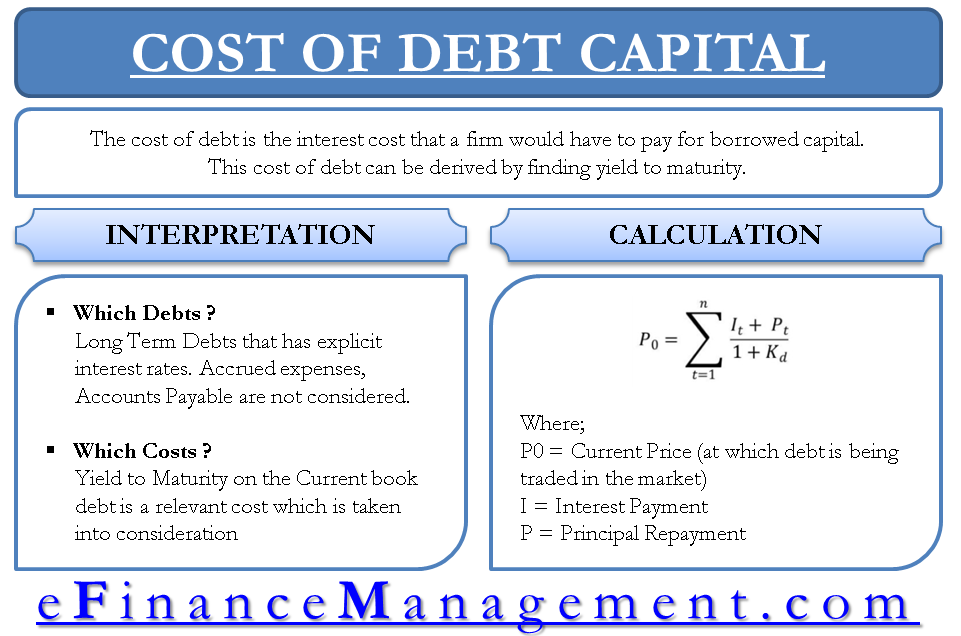

Cost Of Debt Should Be Interest Cost On Capital Yield To Maturity Efm

Cost Of Debt Kd Formula And Calculator Excel Template

Free Cash Flow To Equity Fcfe Formula And Calculator Excel Template

What Is Simple Interest Internal Control Business Analyst Simple Interest

How To Get A Loan From A Bank

Pin On Go Math 16 1 Grade 8 Answer Key

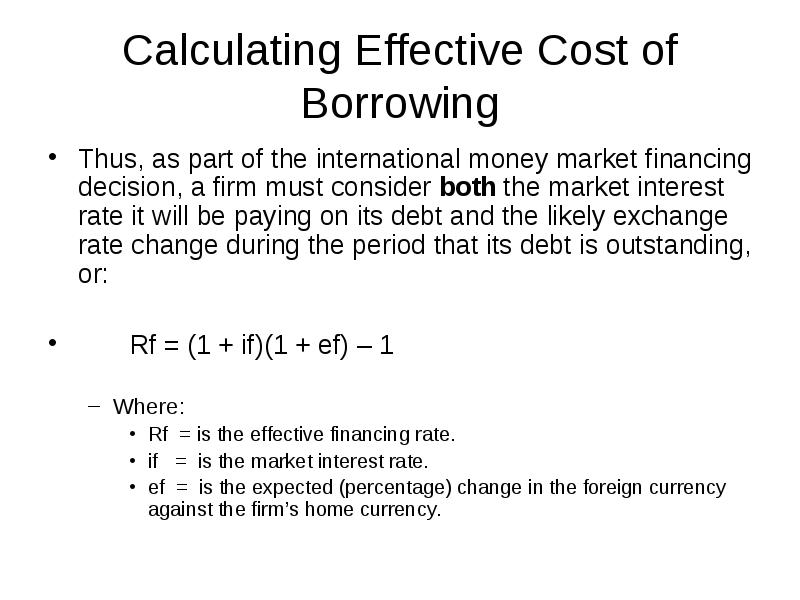

International Finance Chapter 18 Addendum Financing And Investing Short Term

Chapter 15 Mortgage Calculations And Decisions Ppt Video Online Download

Efinancemanagement Financial Life Hacks Finance Accounting And Finance

Difference Between Lease And Finance Economics Lessons Accounting Basics Business Management

Cost Of Debt Kd Formula And Calculator Excel Template

Journey To Becoming A Chartered Accountant Calculation Of Borrowing Cost

Excel Formula Calculate Payment For A Loan Exceljet

Borrowing Base What It Is How To Calculate It